Finding the right tools on a tight budget is one of the biggest challenges for any founder. Affordable accounting software for startups exists to solve this problem, helping you manage finances without breaking the bank. The best options provide essential features like invoicing, expense tracking, and reporting, allowing you to focus on growth.

As a startup, every dollar counts. You need a system that not only fits your budget but also scales with your business. Whether you’re a solo founder or managing a small team, the right accounting software brings clarity to your cash flow, simplifies tax time, and provides the financial insights needed to make smart decisions. This guide will walk you through the top affordable options, helping you choose the perfect fit for your venture.

Table of Contents

Why Affordable Accounting Software for Startups is a Game-Changer

For most startups, the journey begins with a spreadsheet. It’s simple, free, and seems sufficient at first. But as your business grows, so does the complexity. Manually tracking invoices, expenses, and payroll quickly becomes overwhelming and prone to errors. This is where dedicated accounting software becomes essential.

The right software automates these tedious tasks, saving you countless hours and reducing the risk of costly mistakes. It provides a real-time view of your financial health, which is crucial for making informed business decisions, managing cash flow, and securing investor confidence. For startups, moving from a spreadsheet to a proper accounting tool is a critical step toward building a sustainable and scalable business. It’s not just about bookkeeping; it’s about creating a solid financial foundation for future success.

From Spreadsheet Chaos to Financial Clarity: A Founder’s Story

I remember the early days of my first venture, a small consulting business. We tracked everything in Google Sheets. It worked for the first few months, but then we landed a few larger clients. Suddenly, we were juggling multiple invoices with different payment terms, tracking billable hours, and managing project expenses.

One month, I spent an entire weekend just trying to reconcile our bank statements. I discovered we had missed billing a client for nearly $2,000 worth of work and had forgotten to pay a key contractor. It was a wake-up call. The stress and the financial hit made it clear that our DIY system was holding us back.

We decided to invest in affordable accounting software for startups. We chose FreshBooks because of its strong time-tracking and invoicing features, which were perfect for our service-based model. The difference was immediate.

- What I Liked:

- Automated Invoicing: We could set up recurring invoices for retainer clients, which saved time and ensured we never missed a payment.

- Expense Tracking: Snapping photos of receipts with the mobile app and linking them directly to projects was a game-changer for managing costs.

- Professional Look: Our invoices looked far more professional, which improved our brand image and client trust.

- Clear Financial Picture: For the first time, I could see our profit and loss at a glance without spending hours manipulating spreadsheets.

- Areas for Improvement:

- Inventory Management: FreshBooks wasn’t built for inventory-heavy businesses. If we had been selling physical products, we would have needed a different solution.

- Advanced Reporting: While the basic reports were great, we sometimes needed more customizable analytics, which required upgrading to a higher-tier plan.

This experience taught me that the “best” software depends entirely on your business model. For service-based startups, FreshBooks was a perfect fit. For SaaS companies or e-commerce stores, other platforms might be more suitable. The key is to find a tool that solves your specific financial pain points without adding unnecessary complexity or cost.

Choosing Your Platform: Cloud vs. On-Premise

When selecting accounting software, one of the first decisions you’ll face is whether to go with a cloud-based or an on-premise solution. Each has distinct advantages, and the right choice depends on your startup’s needs for accessibility, control, and budget.

Cloud-Based Accounting Software: Access from Anywhere

Cloud-based accounting software is hosted on the vendor’s servers and accessed through a web browser or mobile app. This model, often called Software-as-a-Service (SaaS), has become the standard for most modern businesses due to its flexibility and scalability.

Industry data shows that the global market for cloud accounting software is projected to reach $40.8 billion by 2030, growing at a CAGR of 16.7%. This rapid adoption highlights its benefits for businesses of all sizes, especially dynamic startups.

Key Strengths of Cloud Software:

- Accessibility: Log in and manage your finances from any device with an internet connection. This is ideal for remote teams and founders on the go.

- Automatic Updates: The vendor handles all software updates and security patches, ensuring you’re always on the latest version without any IT overhead.

- Scalability: Plans are typically tiered, allowing you to easily upgrade and add features or users as your business grows.

- Collaboration: You can grant access to your accountant, bookkeeper, or team members, enabling real-time collaboration.

On-Premise Accounting Software: Total Control and Ownership

On-premise accounting software is installed directly onto your company’s computers and servers. This traditional model gives you complete control over your data and the software environment. While less common for new startups, it can be the right choice for businesses with specific security or customization requirements.

For example, a company in the healthcare or finance sector might choose an on-premise solution to comply with strict data privacy regulations that require storing sensitive information on-site.

Key Strengths of On-Premise Software:

- Data Control: Your financial data is stored on your own hardware, giving you full ownership and control over its security.

- One-Time Cost: You typically pay a one-time license fee, which can be more cost-effective over the long term compared to recurring subscription fees.

- Offline Access: You can access your software and data without an internet connection, which is beneficial if you have unreliable connectivity.

- Customization: On-premise systems often offer greater potential for deep, custom integrations with other business systems.

For most startups, the flexibility, low upfront cost, and ease of use of cloud-based accounting software make it the superior choice.

Top Affordable Accounting Software for Startups in 2025

Navigating the market for affordable accounting software for startups can be tough. To help, we’ve analyzed some of the top contenders, highlighting their strengths and who they’re best suited for.

1. Wave: The Best Free Option

Wave is an excellent starting point for early-stage startups and freelancers with tight budgets. Its core accounting, invoicing, and receipt-scanning features are completely free.

- Best For: Freelancers, solopreneurs, and new startups that need basic, no-cost accounting.

- What I Like:

- Unlimited Invoicing: Send unlimited customized, professional invoices.

- Expense Tracking: Connect unlimited bank accounts to track income and expenses automatically.

- True Accounting: It’s a double-entry accounting system, which provides accurate books and is preferred by accountants.

- Areas for Improvement:

- Limited Integrations: Wave doesn’t integrate with many third-party apps, which can be a limitation as you scale.

- No Project Management: It lacks project management or time-tracking features.

- Paid Add-Ons: Payroll and payment processing come with fees, which is how Wave makes money.

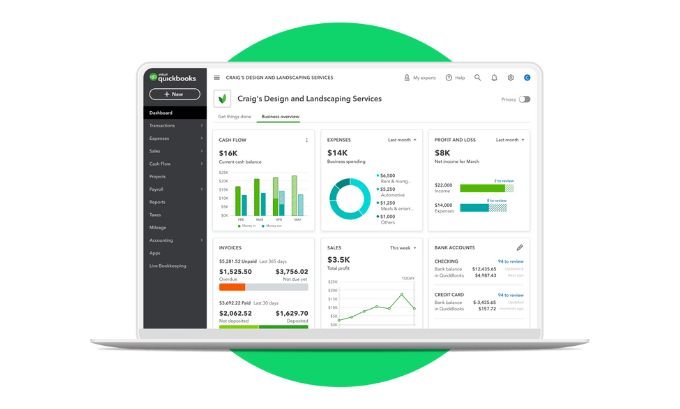

2. QuickBooks Online: The All-Around Industry Standard

QuickBooks Online is one of the most popular accounting platforms for small businesses, and for good reason. It offers a comprehensive suite of features that can support a business from its early days through significant growth.

- Best For: Small businesses and startups that need a robust, scalable, all-in-one solution.

- What I Like:

- Scalability: With multiple plan tiers, QuickBooks can grow with your business, offering features like inventory management and advanced reporting.

- Extensive Integrations: It connects with hundreds of third-party apps, from CRMs to payment processors.

- Accountant-Friendly: Most accountants are familiar with QuickBooks, making collaboration seamless.

- Areas for Improvement:

- Learning Curve: The interface can be complex for beginners without an accounting background.

- Cost: While the entry-level plan is affordable, costs can add up quickly as you move to higher tiers or add payroll.

3. Xero: The Best QuickBooks Alternative

Xero is a powerful cloud-based accounting software that is a direct competitor to QuickBooks. It’s known for its user-friendly interface and unlimited user access on all plans.

- Best For: Startups that need strong invoicing, inventory management, and collaborative features.

- What I Like:

- Unlimited Users: All plans include unlimited users, which is a significant cost-saving for growing teams.

- Clean Interface: Many users find Xero’s design more intuitive and easier to navigate than QuickBooks.

- Project Tracking: Built-in tools to track the time and costs associated with specific projects.

- Areas for Improvement:

- Limited Invoices on Basic Plan: The entry-level plan limits the number of invoices and bills you can send each month.

- Customer Support: Some users have reported that phone support can be difficult to access.

If you’re looking to explore more about affordable accounting software for startups , visit this websites 👇 which offer valuable resource s and up-to-date information for entrepreneurs. 👇

techbullion.in

gogonihon.jp.net

mumbaitimes.net

mindjournal.co

4. FreshBooks: Ideal for Service-Based Businesses

As mentioned in my personal story, FreshBooks shines for service-based businesses like consultants, agencies, and freelancers. Its feature set is built around invoicing, time tracking, and project management.

- Best For: Service-based startups, freelancers, and consultants.

- What I Like:

- Excellent Invoicing: Highly customizable invoices with features like payment reminders and late fees.

- Time Tracking: Easily track billable hours and add them directly to client invoices.

- User-Friendly: The platform is incredibly intuitive and easy to use, even for non-accountants.

- Areas for Improvement:

- Weak Inventory: Not suitable for businesses that sell physical products.

- Limited Users on Lower Plans: The entry-level plan only supports one user.

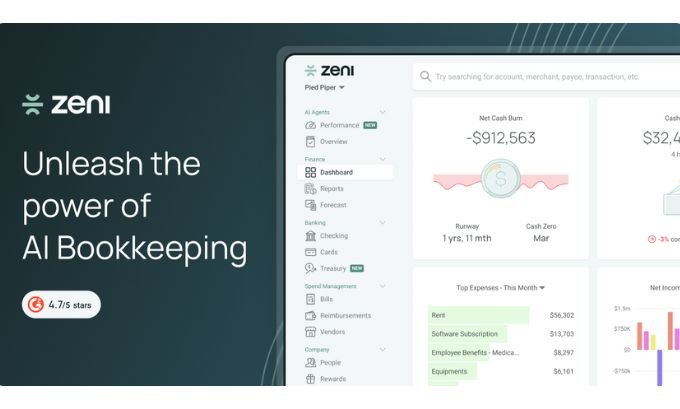

5. Zeni: The Future for Tech and SaaS Companies

Zeni is more than just software; it’s a finance-as-a-service platform. It combines AI-powered software with a dedicated team of finance experts. This makes it a unique and powerful option for well-funded tech startups and SaaS companies.

- Best For: Venture-backed SaaS companies and tech startups that need expert financial management and real-time insights.

- What I Like:

- Daily Bookkeeping: Books are updated daily, providing a real-time view of financials.

- Dedicated Finance Team: Access to a team of bookkeepers, accountants, and a fractional CFO.

- SaaS Metrics: Provides real-time dashboards for key SaaS metrics like MRR, ARR, and churn.

- Areas for Improvement:

- Cost: It’s the most expensive option on this list and is not a fit for bootstrapped or very early-stage startups.

- Not DIY: It’s a managed service, so it’s not for founders who want to handle their own books.

Comparison of Affordable Accounting Software

| Feature | Wave | QuickBooks Online | Xero | FreshBooks | Zeni |

|---|---|---|---|---|---|

| Best For | Freelancers | All-around SMBs | Growing teams | Service businesses | Funded tech startups |

| Pricing Model | Freemium | Subscription | Subscription | Subscription | Managed Service |

| Starting Price | $0/month | ~$30/month | ~$15/month | ~$17/month | Custom (higher-end) |

| Unlimited Users | No | No | Yes | No | Yes (team access) |

| Inventory Mgmt | No | Yes (Plus plan+) | Yes | Basic | No |

| Mobile App | Yes | Yes | Yes | Yes | Yes |

Frequently Asked Questions (FAQ)

1. When should a startup start using accounting software?

You should start using accounting software as soon as you form your business. While a spreadsheet might work for the first month or two, establishing good financial habits from day one will save you significant headaches later. It’s much easier to start with a proper system than to migrate months of messy data.

2. Can I do my startup’s accounting myself?

Yes, many founders handle their own accounting in the early days, especially with user-friendly software like Wave or FreshBooks. These tools are designed for non-accountants. However, as your business grows and transactions become more complex, it’s wise to consult with or hire a professional accountant.

3. What is the difference between accounting software and bookkeeping software?

The terms are often used interchangeably, but there’s a slight difference. Bookkeeping software is focused on recording financial transactions (income and expenses). Accounting software does that and more, offering features for financial analysis, reporting, payroll, and forecasting. Most modern platforms are comprehensive accounting software solutions.

4. Is free accounting software like Wave trustworthy?

Yes, free software like Wave is trustworthy and secure. They use bank-level security to protect your data. Their business model relies on making money from paid services like payment processing and payroll, not from selling your data.

5. How much should a startup budget for accounting software?

A startup can start with a free plan from Wave or expect to pay between $15 to $60 per month for a solid entry-level plan from providers like QuickBooks, Xero, or FreshBooks. The cost will increase as you need more advanced features or add more users.

6. Do I need double-entry accounting software?

Yes. Double-entry accounting is the standard, universally accepted method for business accounting. It ensures your books are balanced and accurate by recording every transaction as both a debit and a credit. All the software mentioned in this guide (Wave, QuickBooks, Xero, FreshBooks) are double-entry systems.

7. What is the best accounting software for a SaaS company?

For early-stage SaaS companies, QuickBooks Online or Xero are excellent choices due to their scalability and integrations. For more mature, venture-backed SaaS companies that need specialized metrics and expert oversight, a platform like Zeni is often the best fit.

Conclusion

Choosing affordable accounting software for your startup is a foundational decision that will impact your ability to manage cash flow, make strategic decisions, and attract investors. The best tool for you depends on your business model, budget, and long-term goals.

For those just starting out, Wave offers an unbeatable free entry point. As you grow, platforms like QuickBooks Online, Xero, and FreshBooks provide the scalable features needed to manage increasing complexity. And for high-growth tech startups, innovative solutions like Zeni offer a glimpse into the future of automated finance.

Don’t let spreadsheet chaos hold your business back. Take the time to evaluate your options, sign up for a free trial, and invest in a system that will provide a clear path to financial control and sustainable growth.